NEWS

Featured News

Trending News

DELIVEROO SHARES RALLY ON FIRST DAY OF RETAIL TRADING

Shares in food delivery startup Deliveroo rallied on Wednesday as its first day of unconditional trading on the London Stock Exchange began.

Wednesday marked the first time that retail investors could trade shares in Deliveroo, including the 70,000 who invested in the company’s IPO. It followed a week of “conditional” trading that began last week, during which only institutional investors could trade stakes in Deliveroo.

TRUELAYER AND WOMBAT PARTNERSHIP OFFERS PAYMENT APIS

TruLayer’s SaaS platform uses a toolkit to create specialist consumer and server message block (SMB) apps in payments, personal finance management and online lending. The collaboration with Wombat Invest, a swiftly growing startup investment platform that provides a user-friendly and secure interface for both novice and experienced investors, will provide the UK-based fintech with cutting-edge payment APIs for its investment customers.

FINTECH BEHEMOTHS BACKBASE AND ZAFIN FORM NEW PARTNERSHIP

Canada’s leading relationship-based product and pricing capability solutions service provider, Zafin, has announced a strategic partnership with the Dutch banking engagement platform, Backbase. According to reports, Zafin, which is one of North America’s leading fintech companies, will join forces with Backbase to implement its spectrum of solutions onto the Backbase platform.

STOCKS MAKING THE BIGGEST MOVES IN THE PREMARKET: HILTON GRAND VACATIONS, J&J, NRG ENERGY & MORE

Hilton Grand Vacations (HGV) – The timeshare company posted a wider-than-expected loss for its latest quarter, while revenue was also below Wall Street forecasts. Hilton Grand Vacations said the pandemic has created a challenging environment but said 85% of its properties are now open and operating. Its shares fell 2.3% in premarket trading.

BITCOIN TANKS 10% AFTER ELON MUSK SAYS PRICES SEEM HIGH

Bitcoin slid Monday, pausing its stunning rally after Elon Musk said prices “seem high.” The world’s most valuable cryptocurrency sank over 10% to a price of $51,993 Monday morning, according to data from Coin Metrics. At one point, bitcoin had dipped below the $50,000 level, falling as low as $47,700.

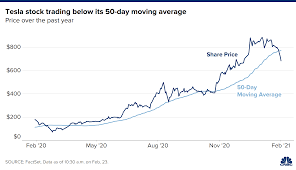

TESLA DROPS AS MUCH AS 13%, TURNS NEGATIVE FOR THE YEAR

Tesla’s recent slide accelerated on Tuesday, as investors rotated out of high-flying tech names. Shares of the electric vehicle maker dipped as much as 13% the stock’s worst day since Sept. before recovering some of those losses. At 10 a.m. on Wall Street shares were down 7.8%.

HOME DEPOT (HD) SHARPLY LOWER DESPITE STRONG QUARTER

Dow component The Home Depot, Inc. (HD) is trading lower by more than 2% in Tuesday’s pre-market despite beating fourth quarter 2020 top- and bottom-line estimates by wide margins. The company booked a profit of $2.65 per share, $0.28 better than expectations, while revenue surged 25.1% year over year to $32.26 billion, beating consensus by more than $5 billion. Quarterly comparative sales growth of 24.5% tracked a booming housing market, underpinned by the exodus out of northeastern and west coast urban centers.

HEDGE FUNDS THAT HUNKERED DOWN AFTER GAMESTOP ARE NOW MISSING OUT ON MARKET GAINS

Hedge funds are still licking their wounds after a retail trading frenzy forced the industry to slash its overall exposure to stocks, leading to an underperformance in 2021. Last month, an army of retail investors who coordinated on social media managed to push GameStop shares up 400% in just one week, creating massive squeezes in a slew of heavily shorted names. Hedge funds getting burned on their short positions scrambled to take down overall risk and sell winners to raise cash.

WEALTHFACE LAUNCHES ADVANCED TRADING PLATFORM

Wealthface, an Investment management company, announced today the launching of its online trading platform for active investors in the Middle East and the United States with the option of allowing clients to build their own portfolio, powered by a factor investing advanced algorithms.

Wealthface offers expert investment services through a blend of investment options, advanced Fintech and professional human expertise. It is licensed by the U.S. Securities and Exchange Commission (SEC), and ADGM’s Financial Services Regulatory Authority (FSRA). Its partnership with the US heavyweights “DriveWealth” will enable Wealthface clients to trade US stocks at a low cost.

COLT TECHNOLOGY SERVICES EXPANDS ITS CAPITAL MARKETS OFFERING INTO LATIN AMERICA

Colt Technology Services recently announced that it is expanding its capital markets offering into Latin America, giving customers from the USA, Europe, and APAC cost effective, low latency access to B3 – one of the world’s largest financial market infrastructure companies and the largest in the region – via Colt PrizmNet.

By continuing to strengthen its coverage in the Americas, Colt is providing global capital market data vendors and trading firms with simpler, more cost-effective access to critical venues in the region. This expansion makes Colt one of the first financial extranet providers to offer access to B3 from all of its 30+ Global PrizmNet PoPs and exchange colocation venues and to on net clients across its global capital markets ecosystem of 160+ exchanges, venues, and service providers, and 10,000+ participants.

CLEVA LAUNCHES TO BRING FINTECH TO THE CARE SECTOR

Cleva, a fintech developed for the home care sector, today launched its payments system for home care agencies – bringing a safe, quick and easy way for carers to shop and handle expenses for people under their care using a single card, and removing the hassle and admin of using cash.

The new system brings proven technology developed by a leading UK-fintech to a whole new market, enabling care agency staff to spend more time looking after the clients they care for, and ensuring transparency of payments for both those under care and their families.

JEEVES, THE FINTECH BUILT FOR GLOBAL COMPANIES, LAUNCHES ITS ALL-IN-ONE CORPORATE CARD AND CAPITAL FINANCING SERVICES FOR HIGH-GROWTH STARTUPS IN CANADA

Jeeves, the all-in-one expense management platform for global startups, announced today that it has officially launched its product and services in Canada. This expansion into the Canadian market follows the company’s highly successful funding rounds of a Series A at $31 million USD followed by a Series B of $57M. Both rounds were completed in 2021 in less than 90 days of each other for a total raise of $183M USD, and a valuation of more than $500M USD. The Canadian launch is the latest in a momentous year of growth for the company.

DISCOVERY DATA LAUNCHES ADVISOR INTENT INDICES POWERED BY ADVISORTARGET TO TRACK FINANCIAL ADVISOR BUYING INTENT TRENDS

Discovery Data, the market leader in data, insights, and analytics for the financial services and insurance industries, announced today that it has co-developed with AdvisorTarget its new Advisor Intent Indices. Measuring financial advisor buying intent and tracking changes in advisor interest on specific industry topics over time, Advisor Intent Indices empower product distributors, recruiters, marketers, and data scientists with highly accurate first-party information on industry-level and advisor-level intent in near real-time.

The Advisor Intent Indices use a scoring model to compare advisors’ overall engagement with financial news to individual engagement, providing month-to-month trends for gauging changes in advisor interest. With a range from 0 to 200, the score indicates the level of interest on topics such as Recruiting, Real Estate Equities, and Muni and High Yield Bonds. For instance, a Real Estate Equities index level of 195 would indicate overwhelming interest on this topic.

WEIS MARKETS SELECTED COLLABORATIVE SOLUTIONS TO DEPLOY WORKDAY FINANCIAL MANAGEMENT AND WORKDAY HUMAN CAPITAL MANAGEMENT

Weis Markets, Inc. today announced that the company has selected Collaborative Solutions, a Workday services partner, to deploy Workday Financial Management and Workday Human Capital Management (HCM) to drive future business value.

Workday Financial Management and Workday HCM support a full range of financial and people-based processes and help provide real-time operational visibility, along with the speed and agility to adapt to business growth and change.

LEADING FINTECH STARTUP CAPCHASE ANNOUNCES REBRAND, REFLECTING MISSION TO MODERNIZE BUSINESS FINANCE

Capchase, the New York-based provider of non-dilutive capital for recurring-revenue companies, announced today that it has launched a new brand identity that will appeal directly to fast-growing businesses in need of flexible funding.

The new branding includes a refresh of all Capchase digital and print assets, including a new logo, a modular design system which can be iterated for each new product launch, and a new website. Central to the new brand identity is a representation of a ‘fast-forward’ button which can be seen in the absent space of the logo, reflecting Capchase’s ability to help companies accelerate growth by bringing future revenue forward to today, and taking the time out of managing and raising capital.

VEEM ENABLES FINANCIAL INSTITUTIONS ON Q2’S PLATFORM WITH FEE FREE, GLOBAL ACCOUNTS RECEIVABLES AND PAYABLES AUTOMATION

Veem, one of the leading providers of online payment solutions, today announced its availability within the Q2 Innovation Studio Marketplace, making its fee free global accounts receivables and payables (AR/AP) automation platform pre-enabled to 450+ financial institutions (FIs) on the Q2 digital banking platform. This partnership with Q2 Holdings, Inc. (NYSE:QTWO), a leading provider of digital transformation solutions for banking and lending, enables Veem’s payment and AR/AP solutions to be delivered directly to FIs’ customers and small businesses.