NEWS

Featured News

Trending News

UNIFIMONEY ANNOUNCES INTEGRATION WITH Q2’S DIGITAL BANKING PLATFORM TO OFFER DIGITAL WEALTH MANAGEMENT SOLUTIONS

Unifimoney, a turnkey digital wealth management platform, today announced its availability within the Q2 Innovation Studio, making its trading platform pre-enabled to 450+ financial institutions (FIs) on the Q2 digital banking platform.

As banks and credit unions embrace innovative fintech services to better serve their customers and remain competitive, investing and wealth management have become an increasingly critical market where consumer adoption has soared in recent years.

LPL FINANCIAL WELCOMES ELITE FINANCIAL NETWORK

LPL Financial LLC announced today that Elite Financial Network has joined LPL Financial’s broker-dealer, corporate registered investment advisor (RIA) and custodial platforms. The large enterprise reported to LPL that it served approximately $1 billion in advisory, brokerage and retirement plan assets,* and joins LPL from Securities America, part of the Advisor Group network of broker-dealers.

Since 1992, Elite Financial Network has served clients in all aspects of their financial lives. Founded by President and CEO Dan Cairo, the Huntington Beach, Calif. team is comprised of 30 independent financial advisors who take a holistic approach to providing personalized services and proactive wealth management. “Our goal is to guide clients through the many financial milestones in their lives, from saving for a child’s college tuition to building wealth to living in retirement,” said Cairo, who serves as both financial advisor and enterprise leader. The firm’s leadership team also includes Craig Wong, managing partner, and Dan’s wife, Cindy Cairo, co-owner and CFO.

CIBC ADDS EQUIPMENT FINANCE TO THEIR COMMERCIAL BANKING SERVICES

CIBC today announced its new Equipment Finance team within its US Commercial Banking group, its 16th specialty banking area.

“At CIBC, we know how important machinery and equipment are in order to successfully deliver products and services to our clients,” says Bruce Hague, president, US Commercial Banking. “We’re pleased to offer client-centric solutions that are applicable to all business profiles in order to help our clients achieve their ambitions.”

CION DIGITAL RAISES $12 MILLION SEED FUNDING ROUND

Cion Digital, developers of the first enterprise SaaS blockchain orchestration platform, today announced it has closed a $12 million Seed Capital raise.

The capital will be utilized to expand R&D resources and accelerate the rollout of crypto financing and payment solutions tailored for Financial Services companies (Lenders, RIA’s, Banks and Neobanks) and Big Ticket Retailers (Auto, RV/Marine, Jewelry and Luxury Goods) and to expand the capabilities of the firm’s proprietary Blockchain Orchestration Platform for other industries.

FIRST WESTERN FINANCIAL, INC. COMPLETES ACQUISITION OF TETON FINANCIAL SERVICES

First Western Financial, Inc., parent company of First Western Trust Bank, (the Bank), today announced the completion of its acquisition of Teton Financial Services, Inc. (Teton Financial Services), parent company of Rocky Mountain Bank, effective December 31, 2021. The closing of this transaction merges Teton Financial Services’ three branches in the state of Wyoming, total assets of $449.6 million, total deposits of $402.9 million, and total loans of $261.1 million as of September 30, 2021, with First Western Trust Bank. Teton Financial Services also offers trust and wealth management services and had $306.8 million in assets under management as of September 30, 2021. As part of its long-term growth strategy, the merger expands First Western’s presence in Wyoming and allows the Bank to deliver its unique approach to private and commercial banking to more clients in the region.

AMADOR BIOSCIENCE ANNOUNCES THE COMPLETION OF $60 MILLION SERIES B+ ROUND FINANCING

Amador Bioscience, a global translational sciences and clinical pharmacology CRO, announced today that it has completed 60MM USD Series B+ financing led by MSA Capital, a global private equity firm. Other participating investors include Series B Co-leads GL Ventures (venture capital arm of Hillhouse Group) and Sequoia Capital, and Series A lead VC Co-win Ventures.

“Amador’s vision is to be a leading global partner for biotherapeutics R&D success,” said Dr. Bing Wang, Amador CEO and Chairman of the Board. “We strive to provide global-standard translational sciences and clinical pharmacology services to biopharmaceutical companies in the US, China and EU. Completion of the back-to-back Series B and B+ financing marks a key milestone mirroring the End-of-Phase 2 (EOP2) in drug development. With this achievement, we’re committed to expanding our team and business, while keeping Amador’s pledge to provide efficient and high-quality work. We are blessed with the trust and support of our biopharmaceutical clients, employees, collaborators, and in particular our distinguished institutional investors. Together we continue building an innovative and efficient engine to accelerate the global R&D of novel drugs.”

SEABANK ENHANCES DIGITAL BANKING EXPERIENCES WITH GOOGLE CLOUD

Southeast Asia Commercial Joint Stock Bank has chosen Google Cloud as its primary cloud provider to enhance the service quality and customer experiences delivered on its SeAMobile/SeANet digital banking platform. With Google Cloud’s enterprise-grade and cutting-edge technologies, SeABank can optimize costs, strengthen security and accelerate innovation.

MODYO AND TODO1/IUVITY SIGN AGREEMENT TO POWER A NEW BREED OF DIGITAL FINANCIAL SOLUTIONS

It gives us great pleasure to announce today that TODO1/iuvity’s solutions will have the frontend digital financial experience powered by Modyo integrated with TODO1/iuvity’s Open Service Platform. With more than 20 years of digital financial experience, TODO1 is an industry leader powering important financial institutions in Latin America that have served more than 21 million digital customers in the past 12 months.

TODO1/iuvity and Modyo are providing clients and partners with a very compelling value proposition. Modyo’s frontend financial platform combined with TODO1/iuvity’s Open Service Platform’s APIs will give our clients flexibility and acceleration. Time to market can be reduced dramatically while helping to power next-gen digital financial solutions, leveraging the right architecture in the cloud.

CUSO HOME LENDING SIGNS CONTRACT WITH MAINESTREAM FINANCE

CUSO Home Lending, a licensed mortgage company owned by credit unions and The Maine Credit Union League, has announced that they have signed a contract with MaineStream Finance to manage the servicing of their current portfolio of loans and take on servicing of any new loans they close going forward.

MaineStream Finance is a non-profit organization that helps low- to moderate-income borrowers. The company is dedicated to economic development by providing credit, capital, and financial services that are often unavailable from traditional financial institutions. Since 1999, MaineStream has served Maine homeowners, homebuyers, consumers, and entrepreneurs in securing the advice and financing they need to grow and thrive. Services include lending, savings products, classes, and one-on-one advisory support. They work closely with federal and state agencies, foundations, and local financial institutions, including banks, to help them meet Community Reinvestment Act goals through financial education programs, loan capital, and volunteering opportunities for homeowners and small businesses.

MaineStream Finance is a wholly-owned subsidiary of Penquis, which was established in 1967 as a non-profit 501(c)(3) organization dedicated to supporting Maine families in becoming healthy, safe, connected, and financially secure. Penquis is Maine’s largest community action agency serving primarily low- and moderate-income individuals in Penobscot, Piscataquis, and Knox counties, with an even broader impact across all 16 Maine counties. Penquis programs focus on five areas: affordable housing, economic security, school readiness, reliable transportation, and healthy lives. Penquis touches the lives of approximately 6,000 people every day and more than 30,000 each year.

“We are committed to ensuring a top-tier level of services to MaineStream’s existing customers as well as to new customers going forward. We are proud to have supported and served communities across Maine for the past nearly three decades and we look forward to helping even more of our neighbors achieve the dream of homeownership in the years to come.”

Russell Cole, president, and CEO of CUSO Home Lending

“We are excited about this transition,”

“It allows our team to focus on meeting the needs of our new home and business borrowers while being assured that our existing clients are well cared for by CUSO’s talented team and our commitment to customer service.”

Jason Bird, director of Housing Development, Penquis, MaineStream Finance

MX AND BOSS INSIGHTS PARTNER TO ACCELERATE BUSINESS LENDING AND INSIGHTS WITH ACCESS TO REAL-TIME FINANCIAL DATA

MX, the leader in Open Finance, and Boss Insights, a leader in business data aggregation, are partnering to provide small-to-medium-sized businesses (SMB) access to real-time financial business data. This access bridges the data gap between SMBs and their banks — accelerating the speed and accuracy of SMB lending, funding, and payments services so they can spend less time collecting data and more time delighting their customers.

Fintechs, private lenders, and financial institutions often struggle with reliable and efficient access to data in a world where speed is paramount. Boss Insights provides technology that lets service providers increase the speed of decision, speed to monitor, and the cost savings of financial services for SMBs and commercial businesses.

“Boss Insights shares MX’s view that finances should be simple, useful, and intuitive,”

“Together, MX and Boss will empower fintechs, private lenders, and financial institutions with a platform to originate, decide, and monitor the business requests of their SMB and commercial business customers. This will help them make faster, more accurate lending, funding, and payment decisions.”

Keren Moynihan, Chief Executive Officer of Boss Insights.

The partnership between MX and Boss Insights gives SMB owners a 360-degree view of their business customers’ financial health through a single application programming interface (API). The API provides real-time access and integration with accounting, banking, and commerce data from more than 1,000 data sources — such as QuickBooks, Xero, Shopify, Stripe, and Amazon.

“At the 2021 Money Experience Summit, MX announced an expansion of our data offerings to provide solutions for those looking to delight SMBs,”

“Today’s partnership with Boss Insights is an important part of that expansion and our ongoing commitment to help small and mid-size businesses achieve better success.”

Don Parker, Executive Vice President of Partnerships, MX.

Through this partnership, Boss Insights can securely and reliably access financial accounts on the MX financial data platform while MX clients gain better, more in-depth financial insights to manage their finances.

MASTERCARD AND INTEROS LAUNCHED A PARTNERSHIP TO ADDRESS THE FAST-CHANGING GLOBAL RISK LANDSCAPE

Mastercard today announced a new partnership with Interos, the hyper-growth operational resilience company, to further expand its security strategy and bring Interos’ multi-tier risk monitoring capabilities to financial institutions. This new offering allows organizations to proactively detect and eliminate risk across multiple areas – including cyber, financial, ESG, restrictions, geopolitical and operational – throughout their network of business and merchant relationships.

Risk has taken on new dimensions in recent months. A growing number of complex and interconnected supplier and merchant business relationships mean threats can develop anywhere in an organization’s third-party business network. Many enterprises cannot track and mitigate these risks: according to Interos research, just 11% of organizations monitor their third-party risk continuously. However, according to a study by RiskRecon, a Mastercard company, 63% of organizations say managing third-party risk is a growing priority for their organization.

“The threat landscape is evolving rapidly, and financial institutions are being exposed to potential disruption across multiple dimensions,”

“External risks are becoming more sophisticated and complex. Our partnership with Interos makes it simpler for financial institutions to continuously evaluate risk, helping advance security and trust in the digital ecosystem.”

Johan Gerber, EVP, Cyber and Security Products at Mastercard.

Systemic Risk Assessment is the first fully automated platform using artificial intelligence and machine learning to map, monitor, and model the complex web of business relationships that power global trade. The platform features an aggregate operational resilience risk score that allows organizations to quickly evaluate companies they do business with for vulnerabilities based on multiple risk dimensions, providing timely insights that they can act on before they impact a business. It provides the most advanced visibility into global nth party business relationships, spanning over 345 million entities and 18 billion business relationships.

“Systemic risk in our business ecosystems is a challenge that impacts every aspect of our global economy,”

“This partnership with Mastercard is important in providing the ability to pre-solve issues before they become costly crises. Together, we’re excited to bring real-time, continuous insights and operational resilience to every market around the world.”

Jennifer Bisceglie, CEO, and Founder of Interos.

GOLDMAN SACHS COMPLETES ACQUISITION OF NN INVESTMENT PARTNERS

The Goldman Sachs Group, Inc. today announced the completion of the acquisition of NN Investment Partners from NN Group N.V. for €1.7 billion.

NN Investment Partners will be integrated into Goldman Sachs Asset Management with the company’s more than 900 employees joining the Goldman Sachs family and the Netherlands becoming an important location in Goldman Sachs’ European business and a center of excellence for sustainability in public markets investing.

The acquisition brings Goldman Sachs’ assets under supervision to approximately $2.8 trillion1 and affirms its position as a top-five active asset manager globally with leading franchises in fixed income, liquidity, equities, alternatives, and insurance asset management. It also brings assets under supervision in Europe to over $600 billion, aligning with the firm’s strategic objectives to scale its European business and extend its global reach.

The combination further strengthens our platform and provides an expanded product range and dedicated service to clients globally, bringing together the best of both organizations to deliver investment solutions at scale, across all asset classes.

NN Investment Partners is highly complementary to Goldman Sachs Asset Management’s existing European footprint, adding new capabilities and accelerating growth in products such as European equity and investment-grade credit, sustainable and impact equity, and green bonds.

NN Investment Partners has been successful in incorporating Environmental, Social, and Governance (ESG) factors across its product range, with ESG criteria integrated into approximately 90% of assets under supervision2. Over time, Goldman Sachs Asset Management intends to leverage the expertise of NN Investment Partners to complement its existing investment processes, helping the firm to deepen ESG integration across its product range and deliver on clients’ sustainable investing priorities.

“This acquisition advances our commitment to putting sustainability at the heart of our investment platform. It adds scale to our European client franchise and extends our leadership in insurance asset management. We are excited to welcome the talented team at NN Investment Partners, a center of excellence in sustainable investing, to Goldman Sachs and together we will focus on delivering long-term value to our clients and shareholders.”

David Solomon, Chairman and Chief Executive Officer of Goldman Sachs

As part of the transaction, Goldman Sachs Asset Management has entered into a long-term strategic partnership agreement with NN Group to manage an approximately $180 billion portfolio of assets, reflecting the strength of the business’ global insurance asset management capabilities and alternatives franchise.

The partnership also strengthens Goldman Sachs Asset Management’s position as one of the largest non-affiliated insurance asset managers globally, with over $550 billion in assets under supervision, and the acquisition will provide a foundation for further growth in the firm’s European fiduciary management business, building on the success of its platform in the United States and the United Kingdom.

WORKDAY SEES CONTINUED MOMENTUM WITH LARGE ENTERPRISES DEPLOYING ITS FINANCE SOLUTIONS

Workday, a leader in enterprise cloud applications for finance and human resources, has announced continued momentum for its office of finance solutions, as large enterprises around the world continue deploying Workday to help drive digital finance transformation strategies. In the company’s fiscal 2022 fourth quarter, customers including American Financial Group, Bon Secours Mercy Health, Christmas Tree Shops, Federal National Mortgage Association (Fannie Mae), Nuffield Health, Sharp HealthCare, and SS&C Technologies deployed Workday finance solutions to help manage performance and growth and drive business-critical decisions.

Workday also announced a record number of deployments for its core finance offerings — Workday Financial Management, Workday Adaptive Planning, and Workday Strategic Sourcing — in its fiscal year 2022 (Feb. 1, 2021-Jan. 31, 2022), with nearly 1,500 deployments during that period, signaling an increased demand for Workday solutions supporting the office of the chief financial officer (CFO).

Innovation for the Office of the CFO

The company’s broad portfolio of cloud finance offerings brings new levels of visibility and control that go beyond the boundaries of traditional enterprise resource planning (ERP) systems. Together Workday Financial Management, Workday Adaptive Planning, Workday Accounting Centre, Workday Prism Analytics, and Workday Spend Management, which includes Workday Strategic Sourcing, deliver a deep and comprehensive solution for enterprise planning and analysis across all finance processes.

Specifically, Workday continues to drive innovation across its solutions to help global customers:

- Become decision-ready with the Workday intelligent data core. Workday offers a unique architecture that allows finance teams to harness the power of data by blending operational and transactional data into a single source. Workday Accounting Centre, built on this foundation, represents a fundamental change in the way finance teams manage external transactions by dramatically simplifying the transformation of high-volume operational data into accounting.

- Adapt to changing business conditions with continuous planning. Workday Adaptive Planning enables customers to collaboratively forecast and budget with driver-based planning and what-if scenario modeling. Predictive forecasting, powered by machine learning, enables easy evaluation across multiple scenarios, such as changing market conditions, regulatory changes, or currency fluctuations, to rapidly adapt to change.

- Modernize accounting and procurement processes. Workday increases efficiency by embedding machine learning into core processes. With Workday Financial Management, finance teams spend less time on transaction processing and are empowered to focus more on strategy and analysis to drive the business forward. In addition, Workday Spend Management automates the source-to-pay process and provides complete visibility to help finance and purchasing departments strategically manage costs, minimize out-of-policy spending, and optimize purchasing power.

IMPRINT PARTNERS WITH SELINA TO LAUNCH THE SELINA REWARDS VISA CARD

Imprint, which offers branded payments and rewards products, today announced a partnership with Selina, the fast-growing lifestyle and experiential hospitality brand targeting Millennial and Gen Z travelers, to launch the Selina Rewards Visa Card.

Consumers will be rewarded like never before with the new Selina Rewards Visa Card, which includes a $25 sign-up reward, 5% back at Selina locations, and 1% back everywhere else. The card uses Imprint to provide exclusive rewards and cashback with every purchase – users download the Imprint App, connect their bank account, and use the card anywhere that Visa is accepted.

The Selina Rewards Visa Card is available via the Imprint App. Signing up with Imprint takes under a minute, and the Selina Rewards Visa Card comes with no credit inquiries, no interest, and absolutely no fees. Unlike other cards, Imprint allows members to use their rewards immediately. As consumers earn rewards, points are automatically applied to the next Selina purchase.

Brands like Selina are launching with Imprint’s platform to power custom rewards programs that reduce the cost to process payments and reinvest the savings into rich rewards for their customers. As a result, brands can boost retention and customer lifetime value with minimal investment.

“We are incredibly excited to partner with Selina and offer exclusive rewards and customized experiences to their loyal guests,”

“Our mission is to work alongside great companies like Selina to build payments systems that reduce costs to the business and provide every customer with access to great rewards.”

Daragh Murphy, CEO & Co-founder of Imprint.

Selina’s global network of hotels spans 144 open and secured properties across 25 countries in North and South America, Europe, the Middle East, and the Asia Pacific. Selina expects to continue to benefit from the surge in remote working and the prioritization of health, wellness, and experiences among Millennial and Gen Z travelers.

“ We are thrilled to begin this special relationship with Imprint to provide our guests and members with added value as we continue to build a dynamic, engaging, and authentic lifestyle brand that resonates with consumers. This collaboration is just the latest example of how Selina is partnering with innovative companies to ingrain our brand more deeply in the hearts and minds of travelers. ”

Rafael Museri, Selina’s Co-Founder and Chief Executive Officer

VIVA WALLET AND MASTERCARD ACCELERATE DIGITAL TRANSFORMATION IN EVORA

Viva Wallet, with the support of Mastercard, will assist the digital transformation in the city of Evora, enabling local merchants to adopt contactless payments in their stores.

The initiative is intended to encourage SMEs from local businesses to join the acceptance of contactless payments, through Tap On Phone technology, which is provided by the Viva Wallet POS app, thus allowing customers to pay easily, safely and hassle-free, even with international cards. With this innovative technology, merchants can transform any Android NFC-enabled smartphone, tablet or other device into a contactless card terminal, saving the costs associated with dedicated terminals, by simply downloading the application to the merchant’s smartphone.

This digital transformation project kicks off with a campaign to promote and advertise the service, encouraging more than 1,000 local businesses, including restaurants, to join digital payments, improving the shopping experience of their customers, especially tourists, who are not always able to use their cards in traditional national card terminals.

This Viva Wallet initiative in Evora, with the support of Mastercard, aims to educate and raise awareness among merchants, as well as encourage the local population, students and tourists to use contactless payments.

The campaign started on April 4 and will be present in several digital media but also physical media such as billboards and large format, static and mobile, as well as displays in local shops and restaurants and social networks.

“ The Tap On Phone solution, available to all merchants, brings a new paradigm to the payment landscape. The old and bulky payment card terminals, only focused on payments, will soon become obsolete. Viva Wallet is leading the digital transformation of SMEs with the latest technology available. Now, any business can benefit from the Viva Wallet POS app, and turn an Android phone with NFC into a card terminal. Our solution is not only highly innovative but can also be easily integrated with third party applications. And best of all: there are no monthly fees or limitations on the number of “card terminals” a merchant can have! ”

Viva Wallet Country Manager Pedro Saldanha.

“ It is the right time for us to support the digital transition of cities, giving more quality of life to its residents and visitors. Using a contactless card in daily routines is a good example. Mastercard, with Viva Wallet and local stakeholders, wants to make Evora a contactless city, by using a set of innovative services that we have implemented in several cities around the world. It is this global experience that we want to share with the city of Evora, with the people of Evora, with local commerce and businesses, and with all those who visit the city. With this project we are responding to the challenges of tourism and to the dynamization of the local economy, through scalable technological solutions, essential for the future of smart cities. ”

Mastercard Country Manager Maria Antonia Saldanha.

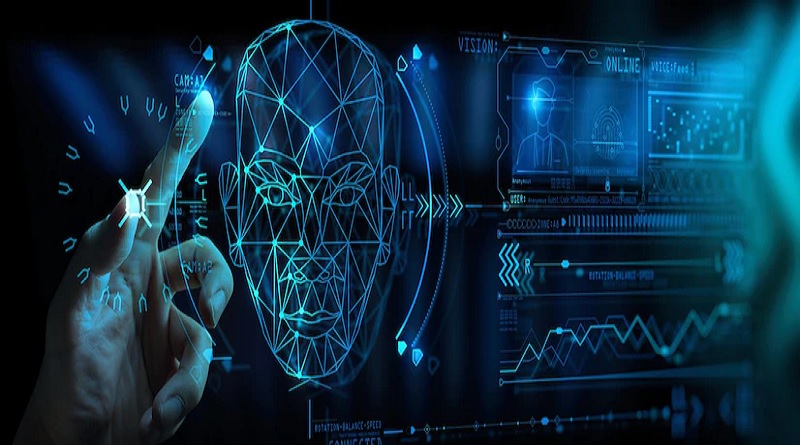

VISA AND POPID FORM PARTNERSHIP TO LAUNCH FACIAL VERIFICATION PAYMENTS IN THE MIDDLE EAST

PopID, a consumer authentication service, and Visa, the world’s leader in digital payments, announced a partnership to collaborate on launching facial verification payment acceptance in the Middle East region. The goal of the partnership is to provide cardholders with new safe, secure, and innovative ways to pay.