WHAT ARE DEFERRED TAX LIABILITIES

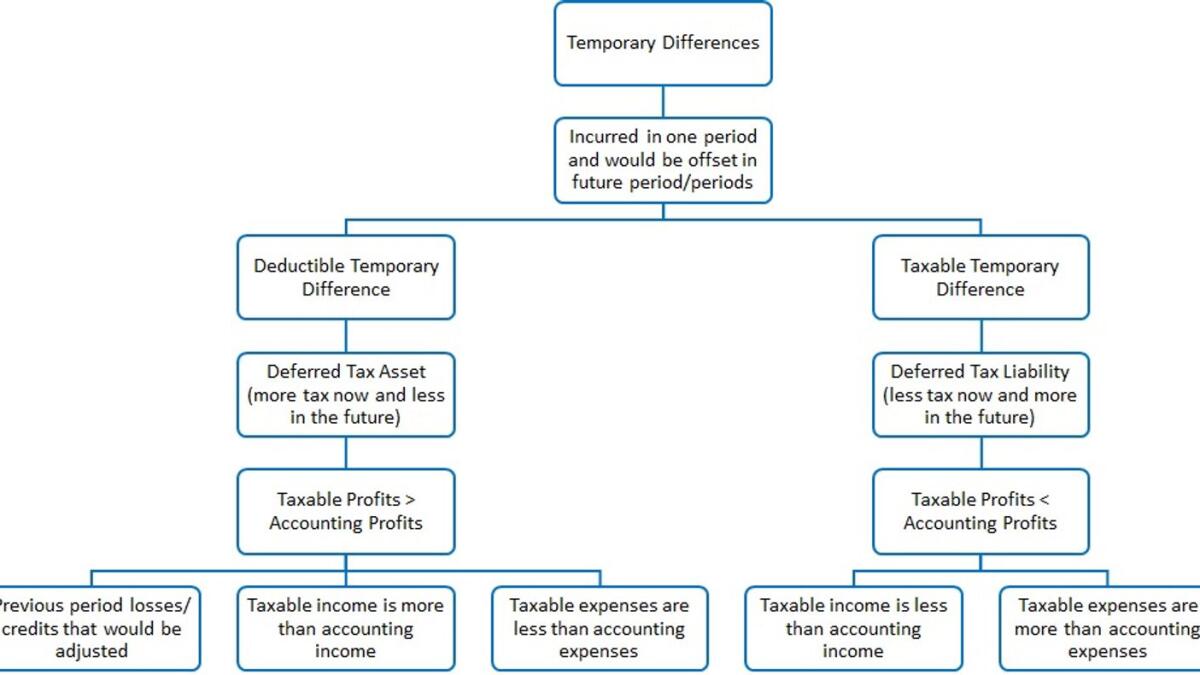

The tax authorities may allow businesses to pay tax on lessor income than the income booked in the statement of comprehensive income, which leads to lower taxable profits. In our previous article titled “difference between accounting and taxable profits”, we established that the difference between accounting and taxable profits could be of permanent and temporary nature.

Moreover, we discussed that temporary differences, which create lower taxable profits in the current period, occur due to taxable temporary differences and ultimately, it creates deferred tax liabilities.

Deferred tax liabilities are the amounts of corporate taxes payables in future periods, and this arises due to the following factors:

• Taxable revenue is lower than accounting revenue due to taxable temporary differences.

• Taxable expenses are higher than accounting expenses due to taxable temporary differences.

The tax authorities may allow businesses to pay tax on lessor income than the income booked in the statement of comprehensive income, which leads to lower taxable profits. Like interest of Dh50,000 on fixed-term deposits accrued by the A Ltd which will be received at the end of the deposit term of five years. Tax authorities will not consider this accrued interest as an income while calculating taxable profits of the current period, and the taxable temporary difference will arise due to this interest income.

In the cases where taxable expenses are higher than the accounting expenses, the typical examples are prepayments, like three years rent of Dh120,000 paid in advance. In the accounting books, it will be amortised over three years at the rate of Dh40,000 per year, while tax authorities in various jurisdictions may follow a cash basis and can ask the registered business to treat full rental payment of Dh120,000 as allowable tax expense in the first year. So, in the current period, taxable expenses would be higher by Dh80,000 due to prepaid rent.

International Financial Reporting Standards [‘IFRS’) states that:

Temporary differences are differences between the carrying amount of an asset or liability in the statement of financial position and its tax base. The tax base of an asset or liability is the amount attributed to that asset or liability for tax purposes.

Taxable temporary differences are: “temporary differences that will result in taxable amounts in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled”.

Keeping in view the above definition of IFRS, in the aforesaid examples, the interest of Dh50,000, and rent of Dh80,000 are taxable temporary differences. The registered business will pay less tax in the current period due to these taxable temporary differences. These amounts will be considered in the future to ascertain the relevant period’s taxable profits.

With the few exceptions, IFRS states that deferred tax liability should be booked on taxable temporary differences.

“A deferred tax liability shall be recognised for all taxable temporary differences, except to the extent that the deferred tax liability arises from:

(a) the initial recognition of goodwill; or

(b) the initial recognition of an asset or liability in a transaction which: (i) is not a business combination; and (ii) at the time of the transaction, affects neither accounting profit nor taxable profit (tax loss)”.

Since taxable temporary differences are Dh130,000 [50,000+80,000], so the registered business will book deferred tax liability of Dh11,700 [130,000*9% (applicable corporate tax rate)].

The period in which taxable temporary differences are higher than deductible temporary differences, in that period tax expense would be higher than tax liability and the differential will be booked as deferred tax liability. The period in which deductible temporary differences are greater than taxable temporary differences, in that period tax expense would be lower than the tax liability, and the differential will be booked as deferred tax asset in the statement of financial position which we have discussed in our previous article.

The above understanding is based on the global practices and requirements of IFRS 12. Once the UAE government introduces corporate law, it will set a clear basis for corporate tax computation.