DESERVE’S COMMERCIAL CARD PLATFORM

We’re revolutionizing the commercial credit card category by offering the first of its kind platform that empowers banks and B2B companies to launch corporate credit and charge cards.

We’re revolutionizing the commercial credit card category by offering the first of its kind platform that empowers banks and B2B companies to launch corporate credit and charge cards.

Apr 19, 2022 | 12:00 PM USA

Apr 19, 2022 | 12:00 PM USA In the final webinar of the series, Shane will bring it all together and give tips for reviewing your pricing matrix and also ways to review your margins retroactively for continuous improvement. Join him in this 30-40 minute webinar that will provide timely advice in this challenging market

Episode 5: How to get overdue invoices paid quickly Welcome to our series dedicated to helping small business owners with their cash flow! Tide Cash Flow Expert and former Small Business Commissioner, Philip King is passionate about helping small businesses master their cash flow. During these live sessions, he shares his top tips and answers

Workday, a leader in enterprise cloud applications for finance and human resources, has announced continued momentum for its office of finance solutions, as large enterprises around the world continue deploying Workday to help drive digital finance transformation strategies. In the company’s fiscal 2022 fourth quarter, customers including American Financial Group, Bon Secours Mercy Health, Christmas

Tranglo Pte Ltd has launched a comprehensive business payment solution that helps businesses send and receive global payments quickly. Tranglo Business is developed exclusively for corporates of all sizes, specifically non-payment providers such as e-commerce traders, local vendors with regional suppliers and customers, cross-border travel agencies, global freelancing and outsourcing platforms, and giggers. Tranglo Business is

Pay.UK and industry experts discuss what impact Request to Pay could have on UK bill payments for organizations and consumers, especially in today’s rapidly changing landscape. Request to Pay solutions to come in different shapes and sizes Pay.UK’s design is unique in a number of key ways.

It’s important to get your finances in shape to start the new tax year with a bang. Here’s how two of our expert financial advisers would start the new tax year. Pension, ISA, and tax rules can change, and any benefits depend on your circumstances. Different tax rates and bands apply to Scottish taxpayers. This

Imprint, which offers branded payments and rewards products, today announced a partnership with Selina, the fast-growing lifestyle and experiential hospitality brand targeting Millennial and Gen Z travelers, to launch the Selina Rewards Visa Card. Consumers will be rewarded like never before with the new Selina Rewards Visa Card, which includes a $25 sign-up reward, 5%

May 05, 2022 | 06:00 AM EDT

May 05, 2022 | 06:00 AM EDT Embedded finance is the seamless distribution and integration of financial products into existing services offered by non-financial brands during the most relevant part of the user journey. Over the last 36-months, Buy Now Pay Later (BNPL) has experienced incredible growth and showing little signs of slowing down –

At Zopa, we’ve been turning money on its head since 2005. From credit cards to loans and savings, we make money work better for you. Loan representative 15.4% APR Credit card representative 34.9% APR variable.

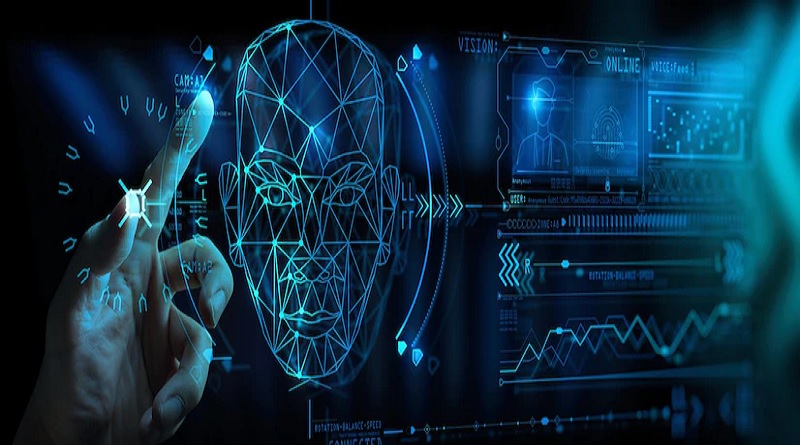

PopID, a consumer authentication service, and Visa, the world’s leader in digital payments, announced a partnership to collaborate on launching facial verification payment acceptance in the Middle East region. The goal of the partnership is to provide cardholders with new safe, secure, and innovative ways to pay. Read More

Adaobi moved to Lagos, Nigeria’s commercial capital in 2018 from Enugu hoping to secure a high paying job in 2018, but when none was forth-coming, she decided to embark on the entrepreneurship journey. To realize this, she approached her bank for a business loan. After weeks of filling all sorts of forms, Adaobi was eventually