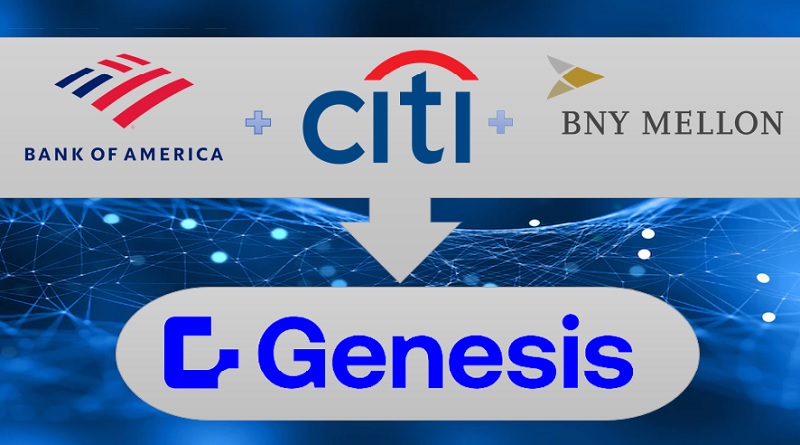

BANK OF AMERICA, BNY MELLON AND CITI MAKE $20 MILLION STRATEGIC INVESTMENT IN GENESIS GLOBAL

Bank of America, BNY Mellon, and Citi announced a $20 million investment in Genesis Global, the low-code application development platform created specifically for companies in the financial markets. Following the company’s $200 million Series C funding announced in February, several key investments were made. “This strategic support from Bank of America, BNY Mellon and Citi