NEWS

Featured News

Trending News

ION AND STRIPE STRIKE BILLING PARTNERSHIP

Newcastle-based FinTech company, ION is proud to announce they have joined Stripe’s Partner Ecosystem (SPE) becoming a strategic partner with Stripe, a leading global technology company that builds payments infrastructure for the internet.

As a ringing endorsement of the partnership, Stripe has appointed ION as a strategic partner for billing implementation in the UK to provide fully integrated payment and billing infrastructure to mid-market businesses. ION and Stripe work together to accelerate cash collection for mid-market organizations, by implementing the financial infrastructure required to automate billing and payments, integrating CRM and accounting software, whilst delivering powerful data analytics.

Stripe offers over 135+ currencies and dozens of payment methods, combined with automated billing, revenue recognition, and global tax calculations covering 35+ countries, giving businesses everything they need to meet the demands of payments, subscriptions, and billing in the modern world.

ION’s team of finance technology specialists collaborates with customers to design and build powerful subscription, billing, and payment solutions, which accelerate revenue, reduced collection time and maximize profitability.

“We are delighted to be selected as Stripe’s strategic billing partner in the UK. Their industry-leading billing and payment solution further enhances ION’s unique proposition as the leading independent financial transformation specialist for business finance leaders in the UK”

Rob Mathieson, Managing Director ION.

“The launch of the Stripe Partner Ecosystem coincides with more businesses looking beyond their organization to navigate the internet economy, and Stripe making it easier to find the right partner for their needs,”

“By partnering with ION and introducing a comprehensive set of partner resources, companies around the world will be able to accelerate their move to online commerce more easily.”

Dorothy Copeland, vice president of global partnerships and alliances at Stripe.

BONIFII SELECTS MASTERCARD AS PREFERRED OPEN BANKING PROVIDER

Bonifii today announced that it has selected Mastercard, through its wholly-owned subsidiary Finicity, as the preferred open banking provider for its Member Pass credit unions to access consumer-permission bank data, to inform underwriting for different loan types across mortgage, auto, personal and small business.

MemberPass, powered by Bonifii, is a digital ID that uses distributed ledger technology and FIDO privacy principles, currently issued by credit unions. FIDO technical specifications state that a FIDO device must not have a global identifier visible across websites, which helps to prevent unwanted and unexpected re-identification of a FIDO user. With the help of Mastercard, Bonifii members can add consumer-permissioned data in addition to the MemberPass digital identity solution to help individuals access capital securely.

“MemberPass is the gold standard in the digital identity market, and as Bonifii’s preferred open banking provider, Mastercard will enable credit unions to step into the digital frontier through the use of consumer-permissioned data,”

“This will complement the current credit rating system by leveraging verification of income and assets for auto, personal, and mortgage lending.”

John Ainsworth, CEO Bonifii’s.

Mastercard’s open banking platform can deliver verification of income, asset, and employment reports directly to credit unions during the underwriting process, all built with consumer-permissioned data from the borrower. This technology enables credit unions to offer a digital-first method through which their borrowers can instantly provide the required information that the credit union needs to make a lending decision and replaces manual processes historically associated with the underwriting process for both the borrower and the lender.

“Mastercard’s open banking technology provides a growth opportunity for credit unions to expand account opening, lending, and loan servicing,”

“Mastercard’s ability to immediately verify account information, via open banking technology and consumer-permissioned data, will be imperative for competitive financial institutions, and digitizing account verification to enhance and better inform underwriting methods will play a critical role in the future of loan processing.”

Andy Sheehan, EVP, U.S. Open Banking at Mastercard.

Mastercard’s open banking technology also reduces the potential for fraud and other time-consuming inaccuracies that credit union underwriters face daily. Together, Bonifii and Mastercard will allow for a more safe, secure, and private opportunity for consumers to permission their data to verify identity and account ownership during the lending process.

LHV GROUP TO INVEST IN FINTECH COMPANY MODULAR TECHNOLOGIES OU

AS LHV Group will make an investment worth EUR 1 million in the Estonian financial technology company Modular Technologies OU, trademark ‘Tuum’. The company developing a new generation banking platform that offers the core system also to LHV UK Limited, a subsidiary of LHV Group.

LHV will invest the EUR 1 million in a convertible bond, that as to the agreement will be converted during the next funding round into shares according to the conditions of the A round funding. The financial impact of the investment is directly related to the increase in the value of the company, the investment is not included in LHV’s existing financial plan.

LHV’s investment is a step toward strengthening the partnership between the two companies and further promoting their common interests. In October 2021, LHV and Tuum entered into a partnership, under which Tuum gained access to LHV’s services, such as the opportunity to provide customers with real-time pound and euro payments, virtual IBANs, and currency exchange accounts, and currency exchange transactions. In March 2022, LHV selected the Tuum platform as the core system for its new bank currently developed in the United Kingdom.

“For LHV, this is an investment that will help us combine our interests with a strategically important partner and further strengthen our position among financial technology companies. Together with Tuum, we can give fintech start-ups and companies operating in other fields the opportunity to enter the market with new flexible financial products more easily and faster,”

Madis Toomsalu, CEO of LHV Group.

Tuum is a fast-growing start-up company that offers financial companies a cutting-edge banking platform. Their customers can assemble a core system that caters to their specific needs from different cloud-based modules. Tuum’s customers include banks and other fintech companies, such as Nets, Multitude Group, and others in addition to LHV UK Limited. As recently January, Tuum raised a total of 15 million euros from investors in the A funding round.

LHV Group is the largest domestic financial group and capital provider in Estonia. LHV Group’s key subsidiaries are LHV Pank, LHV Varahaldus, and LHV Kindlustus. LHV employs over 700 people. As of the end of March, LHV’s banking services are being used by 337,000 clients, the pension funds managed by LHV have 135,000 active clients, and LHV Kindlustus is protecting a total of 147,000 clients. LHV’s UK branch offers banking infrastructure to 200 international financial services companies, via which LHV’s payment services reach clients around the world.

SYNOVUS ANNOUNCES STRATEGIC INVESTMENT IN QUALPAY TO HELP DELIVER A NEW EMBEDDED FINANCE PLATFORM

Synovus Bank today announced that it has signed an agreement to strategically invest in Qualpay resulting in a 60% ownership interest. Qualpay is a provider of a cloud-based platform that combines a payment gateway with robust merchant processing solutions, which allows merchants and independent software vendors (ISVs) to easily integrate payments into their software or websites. The completion of the investment is subject to the satisfaction or waiver of customary closing conditions, including receipt of necessary regulatory approvals.

Beyond growing Qualpay’s core business – propelling the platform’s ability to enter new vertical markets and help a widening range of industries bridge to better payments and reporting experience – Synovus has also chosen to leverage Qualpay’s payments technology as an integral part of Maast, the bank’s new money-as-a-service offering that will launch later this year. Maast will combine embedded payments and embedded banking on one platform, accessed via a common integration layer and a single onboarding experience. Maast will provide a quick and easy way for ISVs to offer payment processing, deposit accounts, debit cards, and loans as features in their software, under their brand, backed by Synovus.

Additionally, the investment will boost Qualpay’s unique offering to ISVs of an easy-to-use, flexible, configurable, and individually-branded experience aligned with customer needs and the growing payment facilitator market.

“This investment in Qualpay demonstrates our commitment to delivering innovative solutions that scale at the speed of business,”

“Maast will help ISVs simplify the integration and delivery of value-added solutions while deepening customer relationships, enabling them to become the go-to provider for software, payments, and banking services in the markets they serve.”

Kevin Blair, Synovus president, and CEO.

“Qualpay is excited to partner with Synovus to propel our growth into platform-as-a-service and augment with embedded finance,”

“As we enter this new phase of growth, we’ll provide ISVs best-in-class customer service from both the merchant and partner side in a way that is simply unmatched by other industry players. We’ve enjoyed a long, fruitful relationship with Synovus, and we are extremely pleased to be chosen to support Maast in the delivery of this innovative fintech solution.”

Craig Gass, CEO of Qualpay.

CIBC INNOVATION BANKING EXPANDS NORTH AMERICAN COVERAGE WITH NEW SEATTLE OFFICE

CIBC Innovation Banking is pleased to announce today that it is opening a new office in Seattle, Washington to help support the growth ambitions of the hundreds of existing and emerging start-ups in the area.

Leading the expansion effort in Seattle is John Flemming, who joins the CIBC Innovation Banking North American team as a Managing Director as the group looks to expand its presence in the greater Pacific Northwest region.

Through this new office, CIBC Innovation Banking will look to deliver its robust expertise in growth capital, advisory, and cash management to innovative companies in the Seattle area, which has seen record funding, hiring, and IPOs over the last few years.

“I’m thrilled to be joining the CIBC Innovation Banking team during this exciting period of growth, and look forward to helping to deliver its unique financial services capabilities to innovation companies across the region as they look to scale their businesses,”

“The start-up ecosystem in Seattle has seen an incredible economic boom in recent years, and this new office opening signals our team’s commitment to supporting the future advancement and acceleration of innovation in this market.”

John Flemming, MD of CIBC Innovation Banking’s Seattle office.

Flemming will bring his unique understanding of the market and over 25 years of experience in the financial services industry – with 15 of those in the tech banking sector – to the team at CIBC Innovation Banking. Flemming joins from Wells Fargo, where he was most recently Team Leader in the Pacific Northwest market for the bank’s Middle-Market Technology Banking Group, focusing primarily on client origination – extending debt financing, providing treasury solutions, and placement of opportunities for the bank’s Strategic Capital and Capital Markets teams.

“We’re excited to have John come aboard our team to open the Seattle office and bring the CIBC Innovation Banking brand and product suite to the greater Pacific Northwest,”

“John’s knowledge, experience, and track record will be valuable to our team as we look to support the future growth of this region’s longstanding technology ecosystem and continue to build out across North America and overseas.”

Mark McQueen, President & Executive MD at CIBC Innovation Banking.

Seattle marks the 13th office to open as the group continues its strategic growth in key technology, life science, and cleantech markets across North America, the UK, and select European markets.

MYPINPAD AND SMARTPESA MERGE TO BECOME THE WORLD LEADER IN MOBILE PAYMENT ACCEPTANCE

MYPINPAD, a global leader in mobile payment acceptance and digital authentication solutions, and SmartPesa, a leading provider of payment systems and branch banking solutions, have agreed to merge. The merged entity will operate under the corporate name MYPINPAD.

As the industry moves towards adopting the future MPoC on COTS (Consumer Off-The-Shelf) mobile payments standard established by the PCI Security Standards Council, MYPINPAD customers will benefit from increased scale, a broader product offering, and the guarantee of continued support. The merger establishes MYPINPAD as the world’s leading supplier to the growing mobile payment acceptance market. The combined entity plans to double its current presence in the Asia Pacific, Latin America, and EMEA regions and target North America in 2022 and beyond.

“We’re thrilled that we can come together with SmartPesa at this time. Their experienced team and strong product capabilities will complement MYPINPAD’s existing suite of PCI certified payments solutions. The combination of our two businesses will accelerate growth, provide economies of scale and better position us to serve our global customer base.”

Richard Forlee, CEO of MYPINPAD.

“We are extremely excited about the future that this merger brings our companies. MYPINPAD is the leading solutions provider of mobile-based payments acceptance solutions backed by a skilled team of experts. Together we can develop innovative new mobile payments solutions for customers and merchants at scale.”

Barry Levett, Founder and Executive Chairman of SmartPesa.

CALABRESE CONSULTING ACQUIRES ALBECK FINANCIAL SERVICES

Calabrese Consulting, an international Special Purpose Acquisition Company (SPAC) advisory firm, today announced that it has acquired Albeck Financial Services, a Houston-based provider of SEC financial reporting and advisory services for small- and mid-cap public companies. Terms of the acquisition, which became effective April 12, 2022, were not disclosed.

The acquisition brings together two leading, women-owned accounting and financial consulting firms to create an 80+ employee company serving more than 350 clients around the world.

Calabrese Consulting, founded in 2012, devotes its practice to providing a wide range of SEC compliance and consulting services to SPACs. Calabrese Consulting has more than 40 team members and has completed over 450 engagements representing more than $65 billion in market value at the time of their respective IPOs. Albeck, founded in 1987, provides financial reporting, due diligence, pre-IPO readiness, corporate governance, internal controls, and non-routine financial functions to domestic and international small- to mid-cap companies, including SPACs. Albeck’s 40 employees operate out of three offices located in Houston and Asia. Albeck has completed hundreds of engagements over the last 35 years.

The combined company, which will be known as Calabrese Consulting, will be led by Managing Member Jenn Calabrese, CPA, MS, CGMA; Chief Operating Officer Mike Rollins; and Partner Christy Albeck. Pre-audit and international services will continue to operate under the name Albeck Financial Services, a division of Calabrese Consulting, and will be led by Ms. Albeck. SPAC clients will be led by Calabrese Consulting, and former Albeck employees will now operate under the Calabrese umbrella servicing their existing clients.

“This combination has created a preferred, full-service resource for private, public, and individual clients around the world, and allows us to work with our clients beyond the IPO,”

“Christy Albeck has earned a reputation for benchmark client service, long-tenured relationships, and attracting and retaining skilled talent. I am thrilled to be working together as colleagues instead of competitors and am excited about our future.”

Ms. Calabrese.

“The nature of our business is rapidly evolving, and increasing access to talent and services in the accounting and advisory sector is crucial. I am confident that the scale created by the combination of our firms will provide us with access to new opportunities and provide a foundation for long-term growth and success.”

Ms. Albeck

FOUR AWARDS FOR BANK OF CYPRUS AT THE “DIGITAL FINANCE AWARDS 2022”

Finance pioneer Bank of Cyprus is rewarded for its digital transformation and its innovative digital products and systems, confirming in the best way possible that the bank provides customers with high-quality services.

At the “Digital Finance Awards 2022”, held in Athens, the Bank of Cyprus secured 4 awards for its pioneering projects and innovative initiatives in the digital transformation of the financial sector in Cyprus.

Bank of Cyprus won the Gold Award for:

- Μost innovative branch in Cyprus

- Digital Onboarding on BoC Mobile Banking App

- Motor and Home Insurance via BoC Mobile Banking App

It also received the Bronze Award for “BoC Mobile Banking App for Best Mobile App”.

“The Bank of Cyprus awards confirm our continuous efforts to adopt innovative tools and services/products that lead the Group to the next day of digital transformation. We hope and work in this direction so that the Group opens wide the horizons for the new digital era in Cyprus. Digital banking is here to stay and is constantly evolving, at the same time being the starting point for more digital tools and channels.”

Acting Chief Digital Officer Demetris Nicolaou.

REVOLUT DEEPENS DIGITAL CURRENCY FOCUS WITH 22 NEW TOKENS

Revolut, the financial super-app with 20 million customers worldwide, today announced another push to the platform’s investment offering with the release of 22 new crypto tokens.

With these latest additions, Revolut’s cryptocurrency service now supports 80+ coins, an increase of x8 when compared to the beginning of 2021.

The newly announced cryptocurrency includes the Metaverse token APE, two DeFi tokens: REQ and ETC, and a wide range of other tokens, such as CLV, FORTH, AVAX, SAND, GALA, AXS, JASMY, ENS, DASH, FLOW, IMX, CRO, IDEX, REN, SPELL, PERP, BICO, COTI, and MLN. It is also available to customers in the UK and EEA.

“This is another big year of crypto, and we’ve given a big boost to our offering while empowering people to take more control of their finances and giving them safe access to new tools and services being built in crypto the space”

Emil Urmanshin, Crypto General Manager at Revolut.

Through its financial super-app, Revolut provides a wide range of financial goods, with cryptocurrency becoming a more and more popular option. Customers can set up a stop or limit order so they don’t have to time the market or use the Recurring Buy function to average out volatility. There are many other options to buy and sell cryptocurrency on Revolut. Additionally, customers can collect spare change while out shopping and deposit it in the cryptocurrency of their choice.

Revolut consumers in Britain are becoming more interested in crypto assets, as evidenced by the fact that this year’s number of transactions performed by British clients who bought cryptocurrencies increased by 20% over that of 2021.

Users can access all crypto tokens regardless of their plan, and Standard customers can upgrade to premium plans if they’re interested in receiving cheaper commissions. Customers can invest as little as $1 in crypto tokens. Revolut has unveiled a test program enabling Bitcoin withdrawals for users in the UK who are on the Metal plan. To enable users to transmit their tokens from Revolut to external wallets and exchanges, the company is looking into ways to introduce cryptocurrency withdrawals in Europe.

Customers of Revolut are reminded that cryptocurrencies are not subject to regulation and are not covered by investor protection plans. Cryptocurrency tokens are erratic investments with swift price fluctuations. The value of cryptocurrencies has the potential to fluctuate sharply both up and down, and trading may be taxed. Revolut supports increasing access to cryptocurrencies but recognizes that not everyone is a good fit for it. As a result, the business advises users to do their research before buying or selling cryptocurrencies. When buying or selling cryptocurrency, customers should consult unbiased sources, understand the distinctions between tokens, and take their individual situations into account. Money is at risk.

SAVANA RAISES $45M IN SERIES A FUNDING

Savana, a financial software player that helps banks and fintechs go digital, has raised $45 million in a Series A funding round led by growth-stage investor Georgian.

Fiserv, a major player in the fintech industry and a reseller of Savana, participated in the round.

A bank’s technological ecosystem is supposed to be “orchestrated” by Savana’s API-first, cloud-native digital delivery platform in order to break down silos and automate service for bank teams and requests made by customers.

The company claims that its technology can enable digital distribution by integrating easily with both new Gen3 platforms and conventional core banking systems.

“This funding round will help support the growth of our digital delivery platform to enable any bank, whether new or going through the transformation of existing technology infrastructure, to speed time to market of new products and services, support continuous digital innovation, and drive significant operational efficiency.”

Michael Sanchez, CEO, Savana.

GLOBAL PAYMENTS ENTERS DEFINITIVE AGREEMENT TO ACQUIRE EVO PAYMENTS

Global Payments Inc., a leading worldwide provider of payment technology and software solutions, and EVO Payments, Inc., a leading global provider of payment technology integrations and acquiring solutions, today announced that Global Payments will acquire EVO in an all-cash transaction for $34.00 per share.

The deal will increase Global Payments’ target addressable markets significantly, strengthen its global leadership in integrated payments, increase its market share in existing faster-growing regions as well as new ones, and enhance its B2B software and payment solutions by incorporating accounts receivable software that is widely accepted by third parties.

“The acquisition of EVO is highly complementary to our technology-enabled strategy and provides meaningful opportunities to increase scale in our business globally,”

“Together with EVO, we are positioned to deliver an unparalleled suite of distinctive software and payment solutions to our combined 4.5 million merchant locations and more than 1,500 financial institutions worldwide.”

Cameron Bready, President and COO, Global Payments.

In addition to enhancing Global Payments’ scale in established markets including the United States, Canada, Mexico, Spain, Ireland, and the United Kingdom, the purchase will increase its global footprint into desirable new geographies like Poland, Germany, Chile, and, following closure, Greece.

Along with enhancing Global Payments’ current B2B and accounts payable products, the acquisition will include industry-leading accounts receivable automation software capabilities. EVO will also introduce a number of important technological partners and proprietary connectors, including those with the most popular makers of ERP software.

“Joining EVO and Global Payments will unite highly complementary portfolios of technology-enabled products and partnerships to create an even stronger organization serving a broader customer base,”

“Over the last decade, the EVO team has worked diligently to advance our innovative solutions, strengthen the service we provide to our bank and technology-enabled partners, and grow our global footprint. This transaction is an achievement for our company, and we believe it delivers compelling value to our shareholders and accelerates our growth opportunities.”

Jim Kelly, Chief Executive Officer, EVO.

GOOGLE AND APPLE ARE BEING SCRUTINISED FOR SUSPECT CRYPTOCURRENCY APPS.

In the world of cryptocurrencies, fraudulent activity is still unchecked. Crypto trading apps are offered by organizations like Apple and Google. As thieves increasingly produce fake apps with names and logos, there has been an increase in fake apps based on these two.

Apple and Google Call for Scrutiny

Who provides this original(the logos, access to these companies, etc) information?

This is the reason why the two companies are being closely examined. The two businesses should respond to inquiries about their efforts to protect investors from fraud. They should also disclose how they keep an eye on cryptocurrency apps. How frequently they examine the procedure is also a cause for concern because it’s time to investigate the companies and see whether they’re the foundation for supporting cyber criminals.

Criminals having access to a company’s logo indicates that the company may have been involved in shady transactions. It is concerning that fraud is becoming more common even while cryptocurrency prices are falling. Cryptocurrency trading apps give users a simple way to transact, yet a lack of confidence may result in withdrawal.

The two have been questioned numerous times about the situation, but they still haven’t responded, despite having until early August to do so. It is concerning how many fraudulent apps there are in the Google and Apple stores, in addition to romance scams and other false medium exchanges. Scammers should be prevented before they cause cryptocurrency to disappear because there is still hope for the future of technology.

What Google and Apple can do?

The two businesses are able to educate investors about safe cryptocurrency app trading. Investors should be informed in some way when there are dubious apps. Reviews of trading apps should be conducted often to protect investors. This is because con artists constantly seek new tactics. The best solutions are consistently delivered by the technology developers for the advancement of crypto. In the meantime, digital currencies won’t have anything to rely on when they start to seem unreliable.

Put under examination, the two will modify their protocols for keeping an eye on crypto programs. In addition, they will outline their prior actions in relation to the situation. Examining the businesses is a significant step in the elimination of crooks since any weak inks will be exposed. The requirement for reviewing the apps has increased because Google and Apple serve as the foundation for crypto operations.

GEMINI UK CUSTOMERS CAN NOW USE PLAID TO CONNECT THEIR BANK ACCOUNTS AND BUY CRYPTO

Gemini, a cryptocurrency exchange, has partnered with Plaid, open banking, and payments platform, to provide UK consumers the opportunity to purchase cryptocurrency using their bank accounts.

The action emphasizes the growing prominence of cryptocurrencies in the financial ecosystem and encourages more everyday customers to diversify their holdings in digital assets.

Customers won’t need to submit their bank information or pay any additional fees in order to deposit funds into their Gemini accounts thanks to the connection. Users of Gemini can now securely send and receive money through Plaid using Apple and Google Pay, among other methods.

Gemini account holders already utilize Plaid in the US to authenticate themselves, connect to their banks, and make deposits.

“Integrating with Plaid in the UK supports Gemini’s mission to increase the accessibility of crypto to more people around the world. Our UK users can now make payments from their bank accounts in minutes, without having to leave the Gemini app.”

“One of the main barriers to building a digital asset portfolio has always been the issue of how to convert fiat currency into cryptocurrency, for example, by moving money from a bank account into a crypto account. Our ability to offer Gemini users multiple secure payment methods, from Apple Pay, Google Pay, to debit cards and now transfers through Plaid, represents significant progress in solving this problem. We are delighted to continue providing customers with an easier experience to fund their crypto accounts.”

Blair Halliday, head of the UK at Gemini.

Plaid announced partnerships with crypto exchanges, including Gemini, Binance.US, SoFi, and Robinhood, earlier this month. The payments platform plans to allow more users to fund their crypto accounts and support businesses in their customer onboarding.

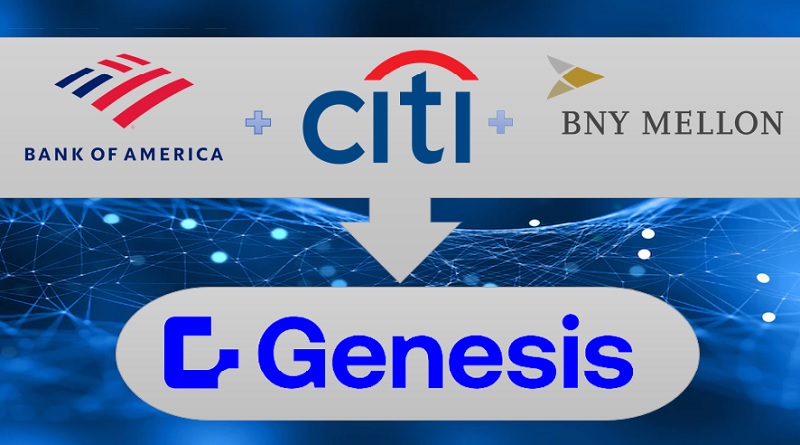

BANK OF AMERICA, BNY MELLON AND CITI MAKE $20 MILLION STRATEGIC INVESTMENT IN GENESIS GLOBAL

Bank of America, BNY Mellon, and Citi announced a $20 million investment in Genesis Global, the low-code application development platform created specifically for companies in the financial markets. Following the company’s $200 million Series C funding announced in February, several key investments were made.

“This strategic support from Bank of America, BNY Mellon and Citi demonstrates their confidence in low-code as an accelerator for the next wave of IT innovation,”

“We are excited to be working with these partners on multiple innovative projects.”

Stephen Murphy, CEO of Genesis.

“Our clients and environment demand more innovation and productivity in terms of IT output,”

“The low-code solution provided by Genesis accelerates the development process and allows us to more quickly build out and launch new trading protocols and processes.”

David Trepanier, Head of Structured Products, Global Credit and Special Situations, Bank of America.

Financial market organizations can speed up the pace of technological innovation while both operating and modernizing intricate legacy systems by speeding up the application development process. Financial services companies prioritize digital transformation as they look to stand out from the competition, innovate, lower the cost and complexity of current systems, and react more quickly to shifting legislation.

“Our investment in and collaboration with Genesis allows us to create applications and solutions faster to meet the increasing demands of our clients,”

“The ability to develop, customize and integrate applications with speed is critical and provides our developers with a toolset to make robust and flexible platforms that can scale. We couldn’t be more excited for this opportunity to work alongside Genesis in expanding the development of low code technology.”

Avi Shua, CIO, Head of Investment Management ,Wealth Management & Pershing Technology, BNY Mellon.

Financial services companies utilize Genesis throughout the software value chain to replace outdated technology, improve current systems, automate spreadsheet procedures, and create fresh, reliable applications from scratch.

“The Genesis platform is built for financial markets,”

“The platform eliminates repetitive, non-differentiating work core to many financial industry applications, freeing developers to focus on innovative work and making Technology departments more productive and more strategic.”

Nikhil Joshi, North America Head of Markets Technology at Citi.

Genesis quadrupled both its team size and revenue in 2021. The Genesis buy-to-build approach for IT transformation is seeing more client interest in 2022, which is fueling the growth. With buy-to-build, organizations quicken the speed of IT transformation since the Genesis platform makes it significantly simpler and faster to develop new applications as well as improve or replace legacy systems.

SANTANDER CIB AND SAP JOIN FORCES TO ACCELERATE DIGITALIZATION OF GLOBAL TRANSACTION BANKING SERVICES

In order to advance digitalization across Global Transaction Banking services, Santander Corporate and Investment Banking (Santander CIB) and SAP Spain have formed a strategic partnership. The two companies will work together to develop solutions around the idea of invisible banking, enhance client-to-bank connectivity, offer financial tools to help their clients worldwide navigate supply chain disruptions, and speed up the decarbonization of their industrial activities.

By utilizing the distinctive capabilities and expertise SAP can provide, the agreement will streamline how Santander CIB interacts with its clients. This will result in multiple benefits for the clients, from streamlined connectivity to value-added services related to counterparty risk and supply chain analytics, among other things.

Santander CIB has improved its connectivity capabilities by joining SAP Multi-Bank Connectivity as the first bank in the European Union as a first step (MBC). Due to its safe, quick, and simple deployment, SAP MBC increases the efficiency of Santander CIB’s onboarding of new clients. This would enhance the client experience overall, reducing expenses and speeding up installation to achieve seamless connectivity.

With the goal of transforming the client-to-bank interactions for the entire portfolio of GTB products, this strategic partnership will allow Santander CIB to advance in providing invisible banking solutions to its clients by integrating Santander services within corporate Enterprise Resource Planning (ERP).

“This partnership is a step forward in the digitalization of the solutions we provide to our clients, with a strong focus on connectivity, supply chain management and energy transition. We already have a strong transaction banking solutions portfolio in Europe, America and Asia that help our clients navigate the complexity of doing business globally. This value proposition comes from the combination of understanding their needs and their daily challenges, leveraging on the latest technology that SAP can deliver and the depth and breadth of our product offering.”

Jose Luis Calderon, head of Global Transaction Banking (GTB) at Santander CIB.

“This agreement, which brings together SAP’s technology and Santander’s products and services, is an example of co-innovation and demonstrates the importance both companies place on improving operational efficiency and customer experience. We look forward to seeing the positive impact it has on our customers.”

João Paulo Silva, SVP & GM, SAP South Europe and Francophone Africa.

SHARES RAISES $40 MILLION FOR ITS SOCIAL INVESTMENT APP

$40 million Series B fundraising round headed by Valar Ventures, the London-based social and community-based investing app Shares is eyeing European expansion and a move into cryptocurrency.

Two months after the app’s UK launch, the round, which brought Shares’ total funding to $90 million in just over a year, was announced.

The startup’s software, which combines all the elements of a social media app with a straightforward investment product, has 150,000 users. Users can share remarks and GIFs with their close friends and family when purchasing or selling to express their opinions about the investment they are making.

Members can monitor and respond in real-time to all of their friends’ investments using an activity stream. Additionally, individuals can use group chats and private direct messages (DMs) to have discussions as well as build group watchlists with their friends to track their upcoming prospects. Users may also view their friends’ investments in stocks as well as their overall gains and losses by viewing their member profiles.

According to Shares, these capabilities enable users to discuss investing more easily without having to rely on third-party sites like Reddit and WhatsApp.

By the end of the year, Shares anticipates launching throughout the rest of Europe with the new finance in place. General managers have already been hired in Amsterdam, Barcelona, Berlin, Stockholm, Krakow, and Berlin.

The company is also planning a Web3.0 push, showcasing its crypto offering that will allow customers to effortlessly transact in the space of digital assets through the Shares application.

“This latest investment from Valar Ventures will only serve to reinforce our growing momentum, supporting the next stage of our expansion into Europe that in turn will act as a springboard into international audiences.”

Benjamin Chemla, CEO, Shares.