HOW BANKS CAN BENEFIT FROM CONVERSATIONAL AI IN PRACTICE

What is Conversational AI?

Conversational AI is the use of Machine Learning (ML) to allow humans to engage organically with devices, machines, and computers through the use of their own speech. As a speaker speaks, the device uses its own natural-sounding speech to understand and find the optimal answer. Customers can communicate with their bank using conversational AI through chatbots, voice assistants, and voice input.

Longer gaps are viewed as unpleasant by humans, thus the system must respond to questions within 300 milliseconds. This requirement, however, presents a difficulty for Conversational AI applications: speed can come at the expense of accuracy, yet long reaction times might impair user happiness. The question-and-answer procedure, like human-to-human communication, must be quick, accurate, and contextual.

Technical terminology, unclear inquiries, and colloquial and ordinary language or phrases are all potential roadblocks for an AI instance. Conversational AI uses extensive Natural Language Processing (NLP) models and elaborate training techniques, typically with billions of different parameters, to address issues like these. High-performance computers with powerful graphics processing units are required for model training (GPUs).

One of the challenges of Conversational AI is that banks and financial service providers, particularly those with a global presence, must maintain NLP models in many languages.

NLP models are currently accessible primarily in English. Fortunately, models can be easily translated into different languages, so developing language-specific models from start is not necessary.

More computing power required

Another problem for conversational AI application developers in the financial sector is that NLP models are becoming more complicated, and the number of data sets utilised to train them is expanding. NLP models will soon include trillions of parameters. But there’s a reason for this complexity.

More training data improves model and application accuracy and performance, and large models can be more easily adaptable to diverse tasks at a cheaper cost. This indicates that for training substantial, local language models, application developers will require GPUs with significantly higher computing power and larger working memory.

What are the benefits?

While the use of AI and machine learning in financial services is groundbreaking, what ultimately counts are the benefits these technologies provide.

Improved customer service via apps such as chatbots and voice assistants is a significant benefit of Conversational AI. Routine inquiries such as “I misplaced my credit card.” “How can I get it blocked?” can be answered more quickly and efficiently, at any moment, and without involving a staff member.

One AI instance can handle thousands of requests like the one above in parallel and respond in seconds. Customers could quickly and conveniently check account balances or transactions, change passwords and PINs, and pay invoices.

AI and advisors hand in hand

A mixed method, in which both the AI system and a bank advisor are involved, is also an option. A customer in need of a mortgage, for example, can use Conversational AI to find out what banks are offering and then clarify precise aspects with a loan professional who has access to all past discussions. If the consumer requests offer documents, either the AI system or the adviser can deliver them by smartphone, notebook, or fixed computer, along with a consultation report.

Banks may address more clients and prospects in a targeted manner while spending less time by utilising AI in this manner.

AI is a high priority for financial firms

According to a Bain & Company study, European banks are lagging far behind US banks in harnessing the full potential of AI solutions.

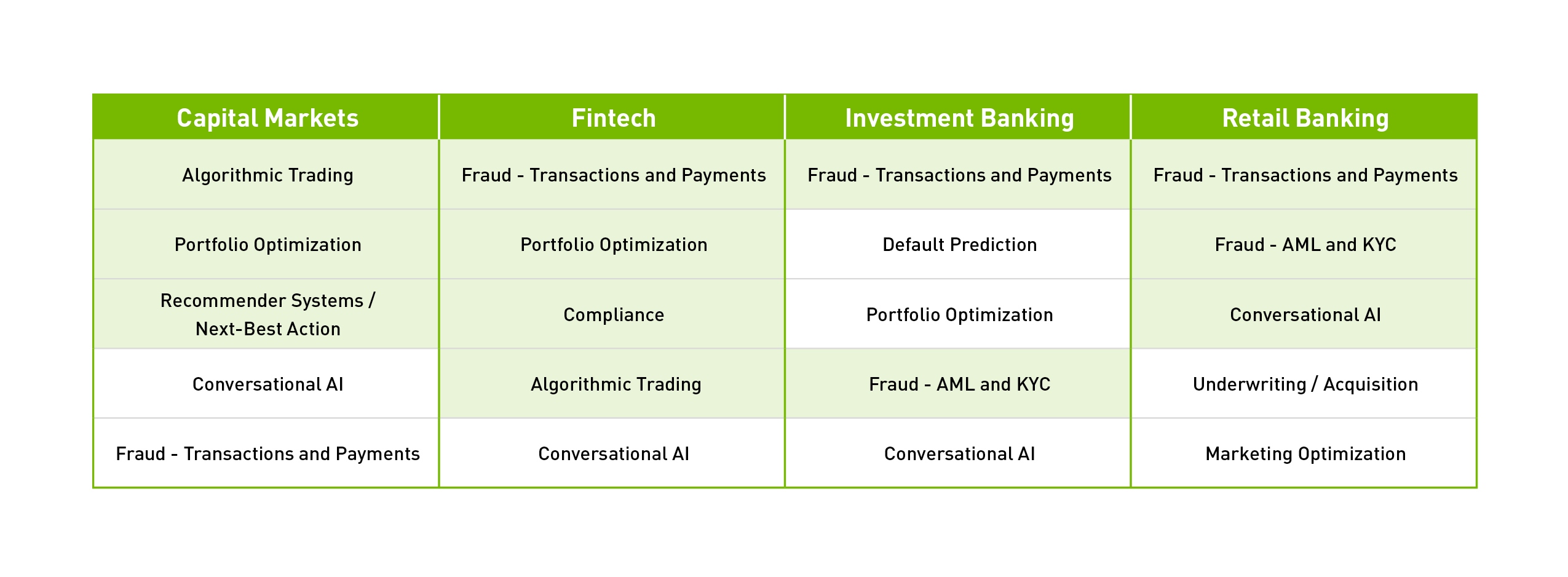

However, European banks have plans for the future. According to NVIDIA’s State of AI in Financial Services research, banks, fintechs, and financial service providers are heavily invested in AI, particularly Conversational AI. According to the report, 28% of financial sector organisations aim to invest in the development and deployment of Conversational AI solutions in 2022, which is more than three times the number in 2021. Conversational AI is now ranked second in the list of the most essential AI applications, trailing AI-based solutions geared to combat fraudulent activity.

What’s next?

Banks and financial service providers may take customer experience to new heights using Conversational AI. This next generation of clients, particularly those who have grown up with the internet, social media, and online, wants their banks to take the next step and further optimise their service with the use of technology such as AI.