Globally in 2020, more than 70 billion real-time payment transactions were processed – an increase of 41% compared to the previous year.

This massive rise in transactions has presented an opportunity for criminals to conduct more fraudulent activities like account takeovers, chargeback fraud, or identity theft, resulting in more than $1 trillion stolen in cybercrime activities in 2020 alone.

NVIDIA’s 2022 State of AI in Financial Services survey found that implementing artificial intelligence (AI) is one way financial institutions protect their customers, data, and bottom line.

Top trends for AI in financial services

Given the vast increase in fraudulent activity, it’s unsurprising that the top AI use case identified by financial services professionals is for fraud detection. 31 percent of respondents use it to protect customer payments and transactions, up from just 10 percent in 2021.

Conversational AI, a type of AI where humans can interact naturally with machines by simply conversing with them, entered the top three use cases this year with 28 percent of respondents using it, followed by 27 percent using AI for algorithmic trading.

Compared to 2021’s survey results, 2022 shows a significant increase in the percentage of financial institutions investing in AI. Conversational AI increased by 8 to 28 percent, know your customer (KYC) and anti-money laundering (AML) fraud detection rose from 7 to 23 percent, and recommender systems increased from 10 to 23 percent.

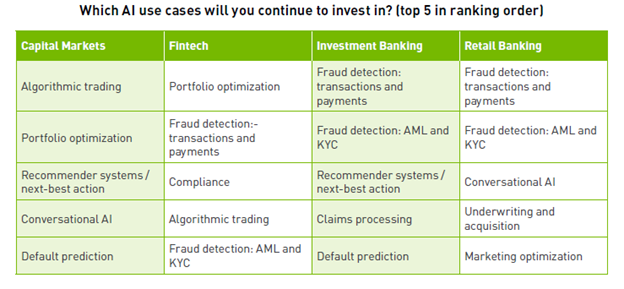

What AI use case is your company investing in?

There are many uses for AI across the financial services landscape.

The report shows that fraud detection of transactions and payments is key for fintech, investment banking, and retail banking institutions. Conversational AI is a priority for capital markets and retail banking, and recommender systems are important for capital markets and investment banking.

Conversational AI for fraud detection and more

Increased fraud attempts have a significant impact on operations, so naturally, it falls high on the priority list for most financial institutions.

Natural Language Processing (NLP) is a form of conversational AI that can be leveraged across KYC and AML. An NLP algorithm can be trained to know everything about a customer – their spending habits, financial histories, unique risk factors, and even voice and behavioral biometrics – to reduce the risk of money laundering and other types of fraudulent activities.

It’s not all about fraud, though. NLP can also be used to optimize and transform the customer experience. Customer experience is incredibly important. Just a one-point decline in a business’ customer experience score can equal $124 million in lost revenue for multi-channel banks, according to Forbes.

In an increasingly 24/7 world, and with a growing volume of customer calls, virtual assistants can be on call day and night to assist with simple inquiries such as account-related questions or product applications. UK-based NatWest’s digital assistant, Cora, is handling 58% more inquiries year on year, completing 40% of those interactions without human intervention. According to Jupiter Research, virtual assistants and chatbots are expected to result in savings of $2.3 billion by 2023.

NLP can also be used for recommender systems. It can generate personalized, recommended offers and next-best actions for each customer based on their individual data.

What does the C-Suite think?

The State of AI in Financial Services survey includes financial professionals across various roles, from c-suite to developers, IT leaders, and managers. This perspective allows for a broader understanding of how groups within an organization perceive their AI capabilities. The survey found that 37 percent of the c-suite view their AI capabilities as industry-leading, whereas only 20 percent of developers have the same perception.

When looking at the challenges organizations face when trying to achieve their AI goals, the c-suite, developers, and IT are unanimous on their concern for lack of data, lack of budget, too few data scientists, poor technology infrastructure, and explainability.

Creating Exponential Value with AI

Knowing a challenge means it’s possible to find a solution. There are several steps companies can take to improve the impact AI can have on customer satisfaction, operational efficiency, and revenue growth.

Successfully moving AI into production is an area of opportunity for organizations, which the survey found that only 23 percent of organizations currently think they can carry out. Knowing the target business outcome, identifying key performance indicators for measuring success, and building the research project as a pilot so that workflows are in place are best practices organizations can implement to improve their ability to scale AI applications into production.

Just 46 percent of organizations use explainability in their AI and machine learning operations. Supporting explainability is critical to integrate into a firm’s overall AI governance practice and doesn’t always need to be done in-house for teams that don’t necessarily have the right expertise.

Pursuing ethical AI is the third opportunity highlighted in the report. Only 26 percent agreed that their organization understands the ethical issues associated with AI and proper governance. Bias, data management, model maintenance, and explainability are crucial aspects of an AI governance framework. Environmental, Social and Corporate Governance (ESG), a way of measuring an organization’s ethical properties, is also growing in popularity within financial services and is a crucial element of ethical AI.

What’s next for AI in financial services?

The future is looking bright for AI. Hiring more AI experts, providing AI training to staff, engaging with third-party partners to accelerate AI adoption, investing more in AI infrastructure, and identifying additional AI use cases are in the works for at least 30 percent of respondents. And the expected outcome is clear, with 37 percent believing that AI will become a source of competitive advantage for their organization.

According to the survey findings, there are many use cases, all of which are growing tremendously year on year. Organizations are aligned on their challenges and committed to investing in their AI strategy to achieve greater customer satisfaction, lower operating costs, higher revenues, and an overall competitive advantage.